How is interest charged and paid?

Standard Variable Rate (SVR)

This is a standard interest rate set by the lender that can go up or down often in line with Bank of England rate changes.

Advantages:

- You have more flexibility and can usually repay your mortgage without any early repayment charges.

Disadvantages:

- Your monthly payments can go up and down which can make budgeting difficult.

- SVR mortgages are not usually the lowest interest rates that lenders offer.

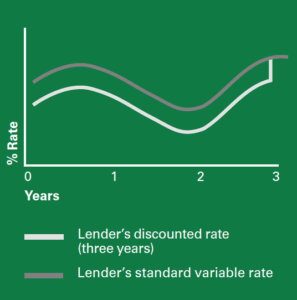

Discounted Rate

Some mortgages start with an initial interest rate set lower than the SVR for a set period of time. At the end of this period, the lender will change the interest rate to the SVR. It’s a good idea to talk to your adviser at this stage because the lender’s SVR may not be the best deal available.

Advantages:

- Your payments could cost you less in the early years, when money may be tight. But you must be confident you can afford the payments when the discount ends.

- Your monthly payments can go up or down which can make budgeting difficult.

- If you want to repay the loan early, there could be an early repayment charge.

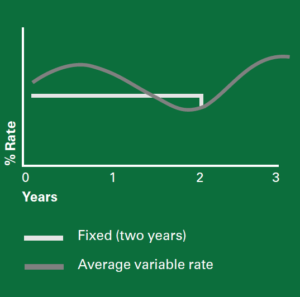

Fixed Rate

If you choose a fixed rate mortgage, your monthly payment will stay the same for a set period, usually two, three or five years. At the end of your fixed rate, your lender will usually change your interest rate to their SVR. It’s a good idea to talk to your adviser at this stage because the lender’s SVR may not be the best deal available.

Advantages:

- You know the exact amount you’ll need to pay each month, which makes budgeting easier.

- Your monthly payment will stay the same during the fixed period, even if other interest rates increase.

Disadvantages:

- Your monthly payment will stay the same during the fixed period, even if other interest rates decrease.

- If you want to repay your loan early, there could be an early repayment charge.

Tracker Mortgage

With a tracker mortgage, the interest rate charged by a lender is linked to a rate such as the Bank of England base rate. This means your payments may go up or down.

Advantages:

- The rate you pay tracks an interest rate (for example, the Bank of England base rate). If the rate changes the tracker rate changes by the same amount.

Disadvantages:

- Some lenders impose a ‘collar’ which means the interest rate won’t fall below a certain level, even if the rate it’s tracking continues to reduce.

- Your monthly payments can go up or down which can make budgeting difficult.

- If you want to repay the loan early, there could be an early repayment charge.

Offset Mortgage

An offset mortgage is generally linked to a main current account and/or savings account which are all held with the same lender. Each month, the amount you owe is reduced by the amount in these accounts before working out the interest due on the loan. This means as your current account and saving balances go up, you pay less mortgage interest. As they go down, you pay more. Linked accounts used to reduce mortgage interest payments do not attract interest.

Advantages:

- Mortgage payments can be reduced as savings increase, or you may be able to continue paying a higher level and pay your mortgage off early.

- You usually pay tax on your savings. However, if your savings are automatically used to offset your mortgage, you won’t pay income tax on these savings – this is particularly beneficial for higher rate taxpayers.

Disadvantages:

- All accounts have to be with one lender/bank.

- You need to have a substantial level of savings.

- If you want to repay the loan early, there could be an early repayment charge.

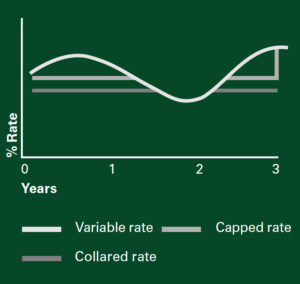

Capped Rate or Capped and Collared Rate

With this type of mortgage, the interest rate is linked to a lender’s SVR but with a guarantee that it won’t go above a set level (called a ‘cap’) or below a certain level (called a ‘collar’) for a set period of time. It’s possible to have a capped rate without a collar.

Advantages:

- You know the maximum and minimum you’ll pay for a set period of time making budgeting easier.

- These products are useful if you want the security of knowing your payments can’t rise above the set level (the cap), but could still benefit if rates fall during the set period.

Disadvantages of capped and collared mortgages

- Even if other rates fall further below, your interest rate for the set period will not go below the level of the ‘collar’.

- If you want to repay the loan early, there could be early repayment charges.

Your home/property may be repossessed if you do not keep up repayments on your mortgage.

Fees and charges

Castle Mortgages offers and initial no obligation consultation. Following a successful mortgage application we will charge a fee based on the complexity of your application and how much work is required and this is only payable once we have found a solution for your needs. This will be discussed with you at your initial appointment. A typical fee charged will be £595.